Unsecured debt—like credit card balances, personal loans, and medical bills—can silently creep up until you’re buried beneath it. Many people don’t even realize they’re in trouble until late fees, calls from collectors, or denied credit applications start piling up. Knowing when to seek help can prevent a financial crisis and put you back in control of your money.

Here’s how to spot the top signs you may need help managing unsecured debt, and what steps you can take today.

What Is Unsecured Debt?

Unsecured debt refers to loans that are not backed by any collateral. Unlike mortgages or car loans (secured by assets), unsecured debts include:

- Credit cards

- Medical bills

- Personal loans

- Student loans

- Store cards or financing

Because there’s no asset for lenders to claim, interest rates on unsecured debt are often much higher, and the repayment terms less forgiving.

Top Warning Signs You Need Debt Help

Recognizing these early signs is crucial to avoiding long-term damage to your finances and credit.

1. Making Only Minimum Payments

If you’re paying just the minimum on credit cards, you’re barely covering the interest—your balance can linger (or grow) for years. This is a classic sign of financial strain.

2. Relying on Credit Cards for Essentials

Using credit for groceries, rent, or utility bills is a red flag that your income can’t cover basic expenses. This typically leads to mounting debt quickly.

3. Borrowing from One Card to Pay Another

This “debt juggling” approach is unsustainable and can cause you to max out multiple accounts while paying excessive interest.

4. Your Debt-to-Income (DTI) Ratio Is Too High

A high DTI ratio (typically above 40%) means too much of your income is going toward debt. This makes it hard to qualify for loans or build savings.

5. You’re Getting Calls from Creditors or Collectors

When debt goes unpaid, collection agencies start calling—this not only affects your peace of mind but severely damages your credit score.

6. You’re Afraid to Check Balances or Open Bills

Avoiding financial realities is a clear psychological sign that your debt is out of control. If you feel overwhelmed or anxious at the thought of your finances, it’s time for action.

7. Your Credit Score Has Dropped Significantly

Late payments, maxed-out credit cards, and high utilization are leading causes of a declining credit score. This affects your ability to borrow in the future.

8. You’ve Tried to Budget, but Nothing Works

If your budgeting efforts still leave you short, your debt may be too large to manage without outside assistance.

Signs You Need Help: Overview Table

| Warning Sign | Why It’s a Problem |

|---|---|

| Making only minimum payments | Debt persists and interest accumulates |

| Using credit for everyday expenses | Indicates a budget deficit |

| Transferring balances between cards | Short-term fix with long-term risk |

| High debt-to-income ratio | Limits financial flexibility and credit access |

| Receiving calls from collectors | Signals late or defaulted payments |

| Ignoring bills or account balances | Delays solutions and worsens credit damage |

Pros of Getting Professional Help

If you’re experiencing one or more of these signs, it’s time to explore solutions like credit counseling, debt consolidation, or debt management programs. Here’s what seeking help can offer:

| Benefit | What It Means for You |

|---|---|

| Lower interest rates | Reduced total debt repayment over time |

| One manageable monthly payment | Easier to track and pay on time |

| Reduced creditor harassment | Agencies can negotiate on your behalf |

| Structured debt payoff plan | A clear path to becoming debt-free |

| Improved credit over time | As debts are paid off, your score may recover |

| Emotional and financial relief | Less stress, more control |

When to Consider Credit Counseling

Credit counseling agencies are non-profit organizations that evaluate your financial situation and offer personalized plans. You should consider this route if:

- You’ve missed multiple payments.

- Your debt-to-income ratio is above 40%.

- You’re overwhelmed by budgeting and repayment strategies.

- You’re considering bankruptcy but want to explore alternatives first.

Don’t Wait for a Financial Emergency

One of the biggest mistakes consumers make is waiting too long to seek help. The earlier you take action, the more options you have, and the less damage done to your credit and emotional well-being.

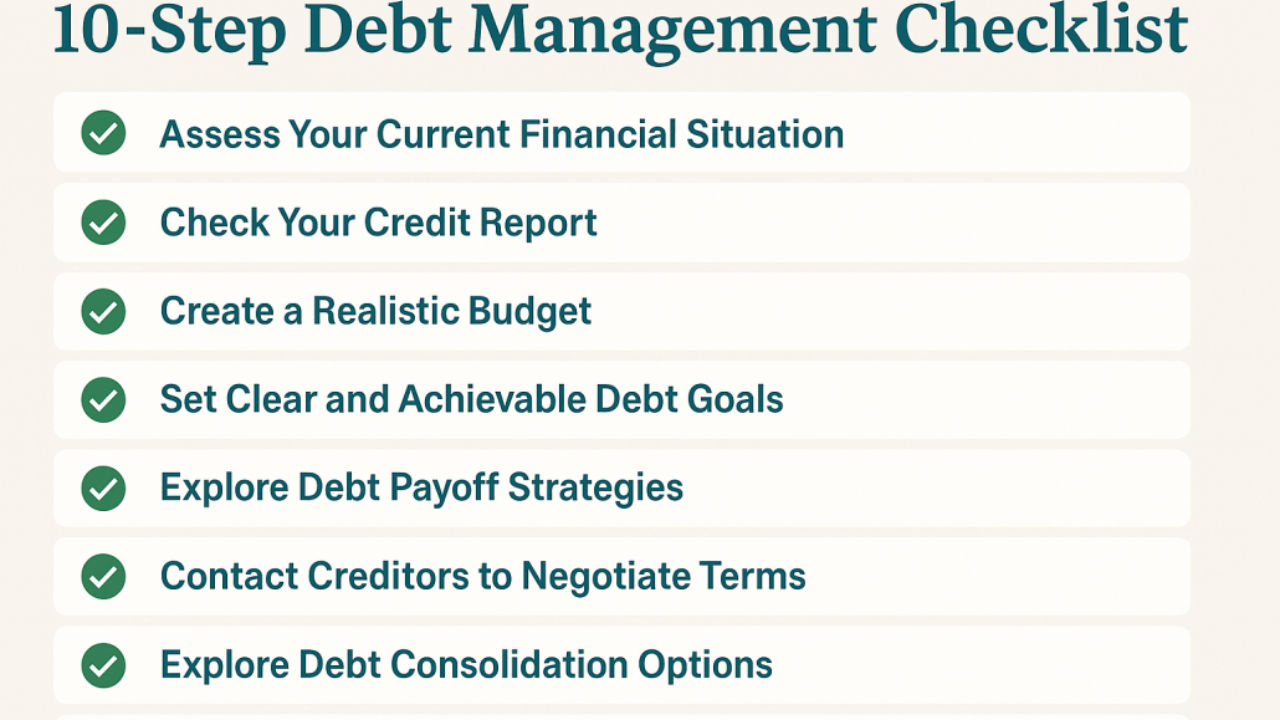

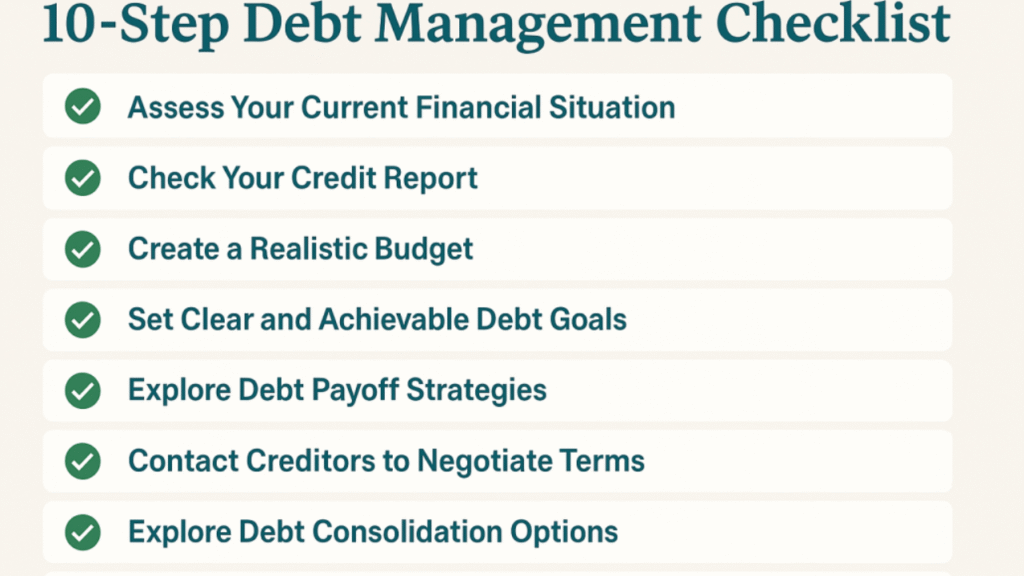

Next Steps if You Recognize the Signs

- Track All Your Debts

List balances, interest rates, and minimum payments. - Assess Your Income and Expenses

Identify gaps and areas for improvement. - Contact a Certified Credit Counselor

They can evaluate your situation and offer solutions. - Consider a Debt Management Plan (DMP)

These plans often reduce interest rates and consolidate payments. - Avoid Payday Loans or New Credit Cards

These will worsen your situation, not improve it.

Summary Table: Take Action Early

| Action Step | Outcome |

|---|---|

| Track and categorize debts | Understand the scope of your problem |

| Seek professional help early | More options, less credit damage |

| Avoid accumulating new debt | Stop the bleeding and stabilize your finances |

| Use structured repayment plans | Get back on track with support |

| Rebuild emergency savings | Avoid future reliance on credit |

3 Best One-Line FAQs

Q: What is the biggest warning sign of unmanageable debt?

A: Making only minimum payments and relying on credit for essentials are strong indicators.

Q: Will getting professional help hurt my credit score?

A: Not necessarily—many programs help stabilize or even improve your score over time.

Q: How soon should I seek debt help?

A: The earlier, the better—don’t wait until you’ve missed multiple payments or gone into collections.