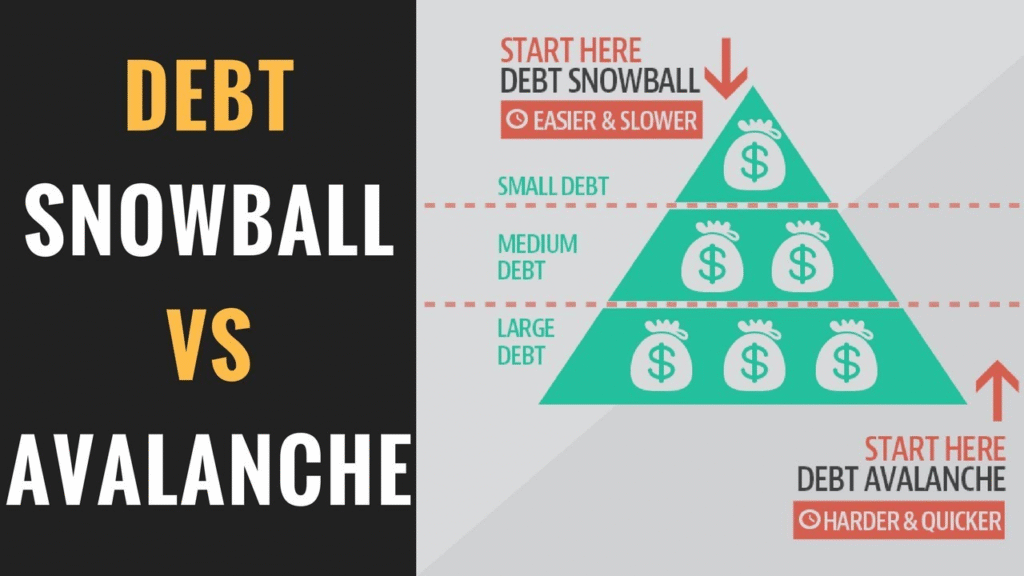

When it comes to getting out of debt, choosing the right strategy can make all the difference in how fast you succeed and how much you save. Two of the most popular methods—Debt Snowball and Debt Avalanche—offer distinct approaches, each with its own benefits and trade-offs.

Whether you’re motivated by quick wins or long-term savings, this guide breaks down both strategies so you can confidently choose the one that fits your financial personality and goals.

Overview Table: Debt Snowball vs Debt Avalanche

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Priority Order | Smallest balance first | Highest interest rate first |

| Psychological Motivation | High (quick wins) | Moderate (slow start, big savings) |

| Total Interest Saved | Less | More |

| Time to Debt Freedom | May take longer | Often faster overall |

| Best for | People who need motivation | People who want to save the most |

| Complexity | Simple and easy to follow | Requires tracking interest rates |

What Is the Debt Snowball Method?

The Debt Snowball Method focuses on paying off your smallest debts first, regardless of the interest rate. You continue to make minimum payments on all other debts, but throw any extra money at the smallest balance.

Example:

If you have the following debts:

- $500 credit card

- $1,500 medical bill

- $3,000 personal loan

You would pay off the $500 credit card first, then move on to the $1,500 bill, and so on.

Key Advantages:

- Quick psychological wins keep you motivated

- Easy to stick with for beginners

- Builds momentum as debts disappear

Potential Downsides:

- You may pay more in interest over time

- Not always the fastest path to becoming debt-free

What Is the Debt Avalanche Method?

The Debt Avalanche Method prioritizes paying off debts with the highest interest rate first. Like the snowball, you make minimum payments on all debts, but put any extra money toward the one with the highest rate.

Example:

If you have the following debts:

- $3,000 credit card at 22% APR

- $5,000 student loan at 6% APR

- $2,000 car loan at 3.5% APR

You’d attack the credit card debt first, because it costs the most in interest.

Key Advantages:

- Saves the most money in the long run

- Faster overall payoff time

- Mathematically the most efficient approach

Potential Downsides:

- Less emotional reinforcement early on

- May take longer to see visible progress

Table: Pros and Cons of Each Strategy

| Strategy | Pros | Cons |

|---|---|---|

| Debt Snowball | – Fast motivation from early wins- Simple to follow | – Pays more interest- Slower overall payoff |

| Debt Avalanche | – Saves most money- Pays off faster in total | – Slower emotional progress- Slightly complex |

Choosing the Right Strategy for You

Not every strategy fits every personality or situation. Here’s how to choose:

Go with Debt Snowball if you:

- Need motivation to stick with the plan

- Like clear and fast progress

- Feel overwhelmed by multiple debts

- Aren’t as worried about the interest costs

Go with Debt Avalanche if you:

- Want to maximize savings

- Can stay motivated without immediate results

- Have high-interest debt eating away at your finances

- Are financially disciplined

Summary Table: Strategy Comparison at a Glance

| Criteria | Debt Snowball | Debt Avalanche |

|---|---|---|

| Speed of Motivation | High (Immediate) | Low (Gradual) |

| Long-Term Interest Saved | Lower | Higher |

| Ease of Use | Very easy | Requires calculation |

| Recommended For | Beginners, emotional spenders | Math-minded savers |

| Requires Interest Tracking | No | Yes |

| Likely Total Repayment | More | Less |

Can You Combine Both Strategies?

Yes! Some people use a hybrid approach:

- Start with snowball to knock out a few small debts

- Switch to avalanche once momentum builds

- This combines the emotional win of quick progress with the financial savings of targeting high-interest debt

Tools to Help You Choose

You can use free online calculators or budgeting apps like:

- Undebt.it

- EveryDollar

- Mint

- You Need a Budget (YNAB)

These tools allow you to simulate both strategies and compare outcomes based on your real debt and income situation.

3 Best One-Line FAQ

Q: Which method is better for saving money on interest?

The Debt Avalanche method saves the most in interest over time.

Q: Which strategy is easier to stick with emotionally?

The Debt Snowball method keeps you motivated with quick wins.

Q: Can I switch between debt payoff strategies later?

Yes, you can adapt or combine strategies based on your financial progress and mindset.