Credit card debt can feel like quicksand—with high interest rates, multiple due dates, and never-ending balances. For many overwhelmed cardholders, debt consolidation appears to be a powerful escape route. But is it truly the best move?

In this article, we’ll explore the pros and cons of debt consolidation for credit card holders, analyze when it makes sense, and provide actionable insights to help you make the smartest decision possible.

What Is Debt Consolidation?

Debt consolidation is the process of combining multiple credit card balances into one new loan or credit product—usually with a lower interest rate and a single monthly payment. The most common methods include:

- Personal loans

- Balance transfer credit cards

- Home equity loans or lines of credit (HELOC)

- Debt consolidation programs from credit counselors

This strategy aims to reduce financial stress, save on interest, and simplify repayment—but it’s not always the perfect fit for everyone.

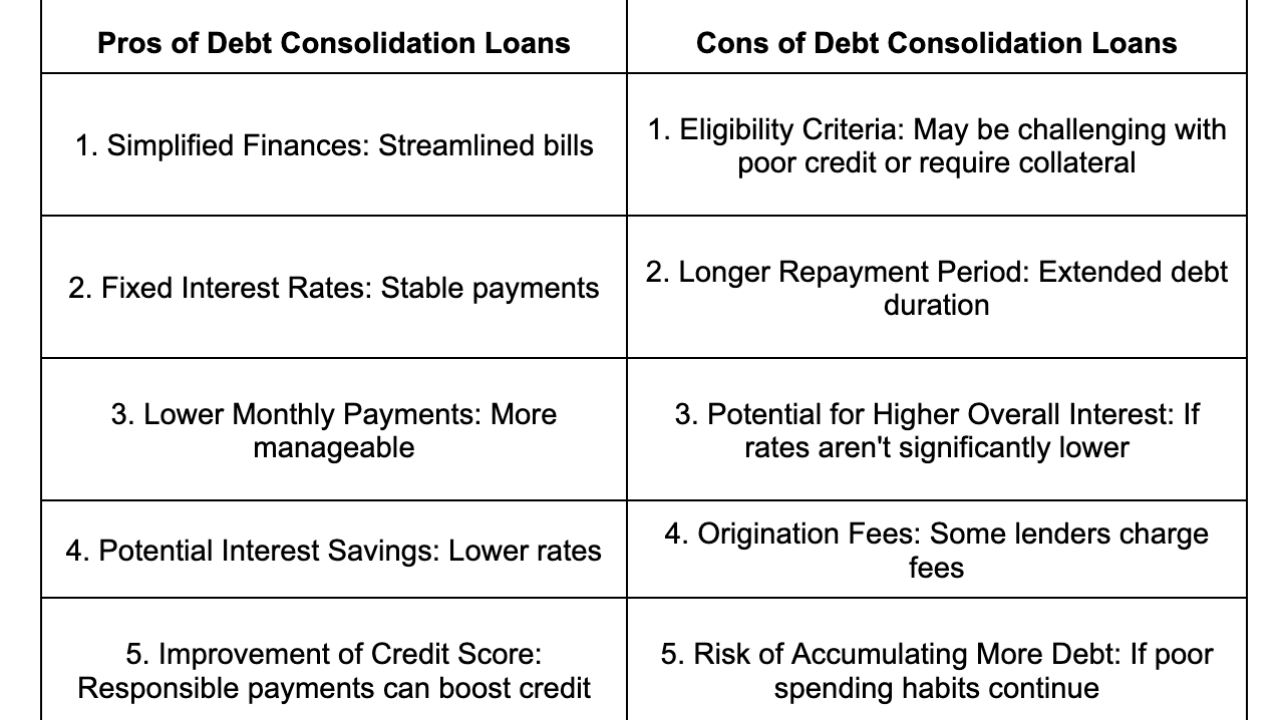

Pros of Debt Consolidation for Credit Card Holders

1. Lower Interest Rates

One of the biggest advantages is replacing high-interest credit cards (often 20% or more) with a loan or card at a significantly lower rate—sometimes under 10%.

Result: Saves thousands over time in interest charges.

2. Single Monthly Payment

Managing multiple credit cards with various payment dates is stressful. Consolidation simplifies your life by combining debts into one manageable bill.

Result: Easier budgeting and less chance of missing payments.

3. Faster Debt Repayment

With a lower interest rate and a structured term (like a 36- or 60-month personal loan), you can pay off your debt more quickly.

Result: Reduced payoff timeline compared to minimum credit card payments.

4. Boosts Credit Score (Over Time)

If used responsibly, debt consolidation can reduce your credit utilization ratio and improve payment history, both of which boost your score.

Result: Improved credit score in the long run.

5. Fixed Repayment Terms

Unlike credit cards with revolving credit, consolidation loans have fixed terms. You know exactly when the debt will be paid off.

Result: Predictability in financial planning.

Cons of Debt Consolidation for Credit Card Holders

1. Upfront Costs and Fees

Balance transfer credit cards often charge 3–5% in fees. Loans may come with origination fees, closing costs, or prepayment penalties.

Risk: Hidden charges can reduce your savings.

2. Requires Good to Excellent Credit

To qualify for a low-interest loan or balance transfer card, you need a decent credit score (typically 670+). Poor credit limits your options.

Risk: May end up with high-rate consolidation loans if credit is low.

3. Doesn’t Solve Spending Habits

Consolidation deals with the symptom, not the cause. Without behavioral change, you might rack up new credit card debt.

Risk: Ending up in deeper debt.

4. May Extend the Debt Timeline

Some people choose longer repayment terms to get lower monthly payments. While affordable, it could mean paying more in the long run.

Risk: More total interest paid over time.

5. Secured Options Risk Assets

Using a home equity loan puts your house on the line. If you default, you risk foreclosure.

Risk: Loss of property if unable to repay.

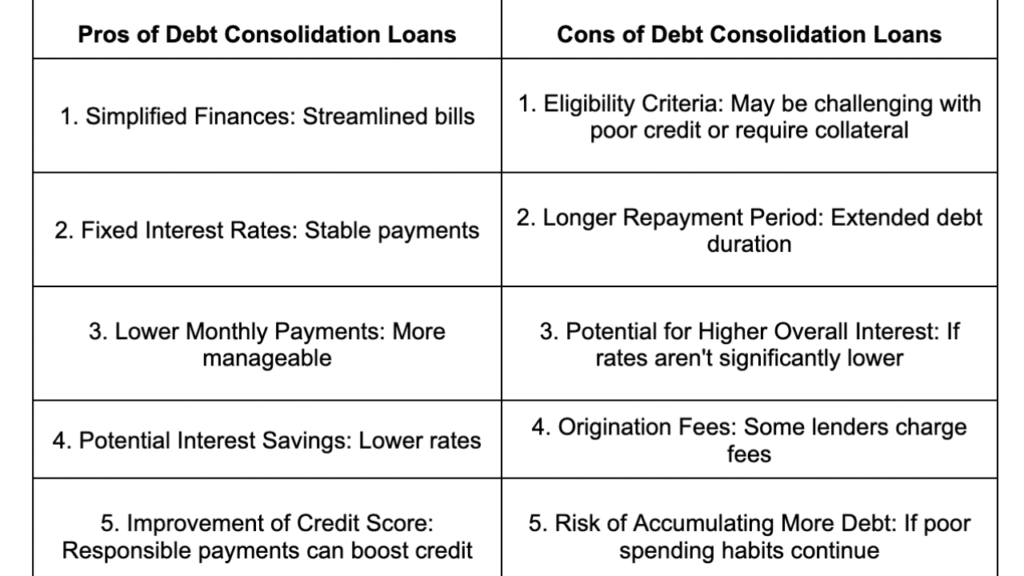

Overview Table: Debt Consolidation Pros and Cons

| Factor | Pros | Cons |

|---|---|---|

| Interest Rate | Lower rates save money | May not qualify for low rates with poor credit |

| Payment Simplicity | One monthly payment simplifies budgeting | Could encourage overspending if cards are reused |

| Credit Score Impact | May improve with lower utilization | Could dip temporarily due to new account inquiry |

| Time to Pay Off Debt | Typically faster with structured terms | May be longer if term is extended too much |

| Fees and Costs | Potential savings on high-interest debt | Balance transfer and loan fees may apply |

| Security of Assets | No risk with unsecured loans/cards | Home equity loans risk foreclosure if unpaid |

When Is Debt Consolidation a Good Idea?

It can be the right solution if:

- You have good to excellent credit and qualify for lower interest rates.

- Your debt is primarily unsecured, like credit card balances.

- You’re committed to avoiding new credit card use after consolidation.

- You want a clear end date for your debt payoff.

When You Should Avoid It

It may not be suitable if:

- You have poor credit and can’t secure favorable loan terms.

- Your total debt is too high relative to income.

- You’re considering bankruptcy or settlement as a more viable option.

- You have secured debts or federal student loans (which have specific relief programs).

How to Get Started with Debt Consolidation

- Check Your Credit Score

- Use free credit tools or reports to know where you stand.

- Compare Consolidation Options

- Research personal loans, 0% balance transfer cards, and credit union programs.

- Calculate Total Costs

- Factor in fees, APR, loan terms, and total interest paid.

- Apply to the Best Option

- Only apply once you’ve compared and prequalified if possible.

- Close or Freeze Old Cards

- Prevent future temptation and new debt accumulation.

Alternatives to Debt Consolidation

If consolidation isn’t the right fit, consider:

- Debt Management Plans (DMPs) with a nonprofit agency

- Debt Settlement for those in severe hardship

- Bankruptcy for unmanageable debt loads

- DIY Snowball or Avalanche Method for motivated payers

3 Best One-Line FAQs

Q: Will debt consolidation hurt my credit score?

A: It may cause a short-term dip, but responsible use usually improves your score over time.

Q: Can I consolidate credit card debt with bad credit?

A: It’s possible, but you may face high interest rates or need a co-signer.

Q: Is it better to pay off credit cards or consolidate?

A: Paying off is ideal, but consolidation helps if you’re struggling to manage high-interest balances.